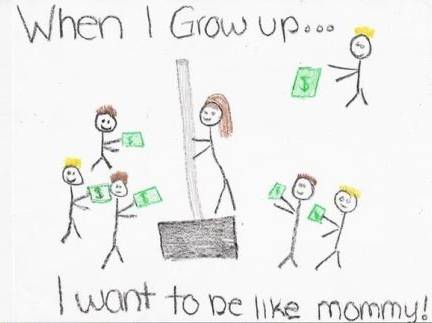

This is me selling a shovel…

A first grade girl handed in the drawing below for her homework assignment.

The teacher graded it and the child brought it home.

She returned to school the next day with the following note:

Dear Ms. Davis,

I want to be perfectly clear on my child’s homework illustration.

It is NOT of me on a dance pole on a stage in a strip joint surrounded by male customers with money.

I work at Home Depot and had commented to my daughter how much money we made in the recent snowstorm.

This drawing is of me selling a shovel.

Sincerely,

Mrs. Harrington

Single Dollar Hypothesis

I invented a new term today after chatting with a young lady over lunch. The term is ‘monoconomics’ or the single dollar hypothesis.

Monoconomics is a transcendental and relativistic approach to economic mechanics in the current reality much the same way that the special theory of relativity reinterprets our perceptions of and combines the constructions of space, time and gravity in physics. This dualistic approach to physics and ultimately our perception of reality can be likened as well to Richard Feynman’s One Electron Universe hypothesis wherein Feynman postulates that there exists only a single electron in the universe, propagating through space and time in such a way as to appear in many places simultaneously.

It is the illusion (and the appearance) of many electrons or more explicitly, many dollars, in the universe at the same time and in a multitude of places that can best be described by the Hindu term, Maya: “the illusion of a limited and purely physical and mental reality in which our everyday consciousness has become entangled.”

As proven by recent events in Japan, globalization has pressed microeconomics to its limit and has translated macroeconomics to a unifying theory ultimately guiding all economies instantaneously. As the nation state erodes, a function of misdirected monetary policy and inefficient social programs and the number of corporations become fewer through mergers, acquisitions and failure the eventuality of a homogenized economy will avail itself wherein the…

When in the course of human events, it becomes necessary…

Listen to the The Declaration of Independence

The unanimous Declaration of the thirteen united States of America

I will let these gentlemen speak for themselves.

When in the Course of human events it becomes necessary for one people to dissolve the political bands which have connected them with another and to assume among the powers of the earth, the separate and equal station to which the Laws of Nature and of Nature’s God entitle them, a decent respect to the opinions of mankind requires that they should declare the causes which impel them to the separation.

We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty and the pursuit of Happiness. — That to secure these rights, Governments are instituted among Men, deriving their just powers from the consent of the governed, — That whenever any Form of Government becomes destructive of these ends, it is the Right of the People to alter or to abolish it, and to institute new Government, laying its foundation on such principles and organizing its powers in such form, as to them shall seem most likely to effect their Safety and Happiness…

In the Summer of 1776, the 33 year old Thomas Jefferson, in a flurry of creativity and passion and in just a few days put forth the Declaration of Independence of the United States. The main body of text was a list of grievances against the British Crown and ultimately by declaration a legal separation between the 13 American Colonies from Great Britain and to that end, those men who signed it ultimately pledged their lives, their fortunes and their sacred honor. In the words of President Kennedy, “And so my fellow Americans, ask not what your country can do for you, ask what you can do for your country…”

We, therefore, the Representatives of the united States of America, in General Congress, Assembled, appealing to the Supreme Judge of the world for the rectitude of our intentions, do, in the Name, and by Authority of the good People of these Colonies, solemnly publish and declare, That these united Colonies are, and of Right ought to be Free and Independent States, that they are Absolved from all Allegiance to the British Crown, and that all political connection between them and the State of Great Britain, is and ought to be totally dissolved; and that as Free and Independent States, they have full Power to levy War, conclude Peace, contract Alliances, establish Commerce, and to do all other Acts and Things which Independent States may of right do. — And for the support of this Declaration, with a firm reliance on the protection of Divine Providence, we mutually pledge to each other our Lives, our Fortunes, and our sacred Honor.

If not us, who? If not now, when? Can we do no less?

MIT Open Course, 18.01, Single Variable Calculus

Please refer to the following:

Gottfried Wilhelm von Liebniz

Calculus

The History of Calculus

Lecture 2, Limits

Lecture 3, Derivatives

Lecture 4, The Chain Rule

Lecture 5, Differentiation

Lecture 6, Exponential & Log

Lecture 7, Hyperbolic Functions

Lecture 9, Linear & Quadratic Approximations

Lecture 10, Curve Sketching

Lecture 11, Max-min

Lecture 12, Related Rates

Lecture 13, Newton's Method

Lecture 14, Mean Value Theorem

Lecture 15, Antiderivatives

Lecture 16, Differential Equations

Lecture 18, Definite Integrals

Lecture 19, First Fundamental Theorem

Lecture 20, Second Fundamental Theorem

Lecture 21, Applications to Logarithms

Lecture 22, Volumes

Lecture 23, Work, Probability

Lecture 24, Numerical Integration

Lecture 25, Exam 3 Review

Lectures 27 thru 39 to Follow

who’s coming with me besides flipper?

Eisenhower’s Farewell Address

JFK’s Address on Secret Societies

Network ‘Money’ Speech

Milton Friedman on Other People’s Money

Milton Friedman on Greed

Larry the Liquidator on Change

Howard Roark on the Rights of the Individual

Hank Rearden ‘Comes Home’ Scene

“This is John Galt Speaking…” Part One

Howard Beale’s ‘I’m Mad as Hell’ Speech

Jerry Maguire’s “Who’s Coming With Me?” Speech

the game

The Derivative Market Simplified

Please watch the following Videos. If you have problems following them, just imagine how difficult it is to understand the Financial Derivative Marketplace. Remember that you will be watching the beginning betting practices and disciplines of a relatively ‘simple’ street game.

We’re not playing Yahtzee, we’re playing Craps!

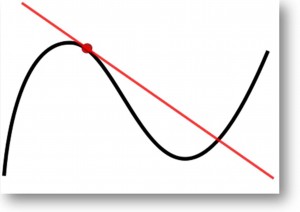

Here you can see the Sliding Line as it travels on the Graphic Representation of a single Trigonometric Function. The Derivative in Calculus is the Slope of the Tangent Line at any point on the Original Function usually given by a simple Linear Equation, y=mx+b for those who remember their Algebra or Introduction to Advanced Mathematics. Regardless, the Tangential Line derives its value by its position on the Function without which it would have no value. Such are Derivatives in the Financial Market Place. They have no real value and are only given by complex formulas and the Future Value of the Asset to which it is linked.

Here you can see the Relative Gross Domestic Products of the Ten Leading Global Economies in 2010 in Millions of Dollars ($USD). The Derivative Market in 1995-6 when Brooksley Born was issuing her warning was $27,000,000,000,000.00. That is 27 Trillion Dollars, with a T. The Derivative Market exploded to over $625,000,000,000,000.00, Six Hundred Twenty Five Trillion Dollars in 2007-8. What percentage of the Derivative Market is the GDP of the United States? 2.3%.

I rest my case (for now).

By the way, that is Marilyn Monroe sitting at a Crap Table.

the warning

Dear Jonathan,

Why Isn’t Wall Street in Jail?

Here is this great article written by Matt Taibbi. I can now see clearly, that the same people who are involved in Political Fund Raising or Fund Direction (towards Political Parties) are the very same people who are either conjuring, managing or at the least, taking advantage of Financial Crimes and Misdemeanors. Regardless, everyone involved, everyone, from the (current) President on down is involved in this malfeasance, a product of a corrupt partnership and system wherein the culprits are immune to prosecution and incarceration.

The Great American Bubble Machine

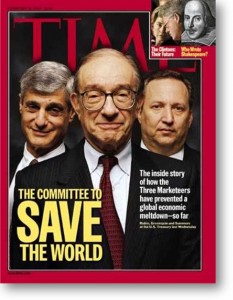

In this article, Matt makes reference to my favorite person of the last two decades, a person who would have stopped (if she were allowed to do so) ‘Black Box’ trading and tried to warn (if they would have listened and acted upon her warning) Alan Greenspan, Robert Rubin and Larry Summers of the possible and impending implosion of the Derivatives Market…Brooksley Born, Head of the Commodity Futures Trading Commission, an attorney, with 20 years experience in Derivative Law.

Historically, it was Lehman Brother’s failure, the collapse of the Derivative’s Market, and the calling of Credit Default Swaps on those Derivatives that led to the collapse of AIG and the shocking revelation to the unwitting general public of the Systemic Fraud and Manipulation in the Financial Marketplace with Credit being frozen, Countless Hundreds of Billions of Dollars of Personal Wealth & Savings, Governmental and Private Pension Fund Assets being lost and then TARP Funds being disbursed as compensation and reward for alleged and yet to be charged Wall Street High Crimes and Misdemeanors.

Again, please watch last night’s episode of Real Time to see Bill’s interview with Matt. If it weren’t so humorous, it would make you nauseous. Perhaps it will do both. ![]()

If you don’t have access to HBO, or want more information and a body of knowledge where you can CLEARLY see the story unfold, please watch the pbs Frontline episode, The Warning followed by Inside The Meltdown and Breaking the Bank.

Watch The Warning on PBS. See more from FRONTLINE.

If you’ve got the time, go see the Charles Ferguson Award Winning Documentary, INSIDE JOB (2010) or better yet, buy it on Amazon and watch it until you know it by heart.

‘Those who cannot remember the past are condemned to repeat it’—-George Santayana

Your pal,

Warren

Wall Street owns DC and not one single individual who devised, manipulated and executed CDSs and MBSs will spend one day in jail and the concepts of justice and accountability have vanished from the social, economic and political terrain.

In 2008 I stood in the streets and chanted for change. Today I stand on a street corner and ask for spare change.

And, I remember a better time on a rainy night and a man named Eddie Willers. And I stop and I ponder…What the hell has happened?

And I can tell you that I know the answer…People who claim that Objectivism allows for ruthless profiteering are misinformed. Objectivism strides on two conceptual legs. The first being vested self interest. The second is personal integrity. Without both Objectivism is nil. And I ask myself, how much is enough…

Do Bill Gates and Warren Buffet violate the precepts of Objectivism as proposed by Ayn Rand? Therein lies the question and the rub. For the rub begs the question…what is the true nature of personal integrity and what is the responsibility of the individual in a closed end society?

It is late, I am tired and I am going to bed. I will let those brighter than I fill in the blanks…for now.

I have no doubt that he will be involved in EXACTLY where it goes and that he will be rational about his choice of where to spend it. He is clearly a man with both a well-defined ego and one of integrity. He wants to leave the world a better place. That will give him satisfaction. Leaving the world a better place is in our self-interest.

Living a life of self-interest doesn’t mean you destroy other people in the process. It means that you make rational choices that benefit you. I reject the notion that you can only benefit yourself at the expense of others. (Just like I reject the notion that you can only help others if you sacrifice yourself.)

It all depends on what you consider a sacrifice and how you view money in terms of goal.

Is a teacher making $35,000 a year and loving what she does living a life of self-sacrifice? No. Because she’s doing what she loves. She’s an amazing success. She’s PRODUCING. On the other hand, a teacher who hates their job IS living a life of self sacrifice.

Is an executive making $20 million a year but swindling the public and his workers a success? No. Because he’s not producing his best. Then think of the character of Hank Rearden — he did his best, paid his workers *more* than the standard wage (union wage) — because he expected the best from them. His product would have *certainly* benefited society — cheaper, longer lasting metal. And he intended to make a great profit from it.

I know that Rand focused on the $. She was from Communist Russia, where $ was evil, so I understand it. But it’s not the *only* form of payment. Think about parenthood and what an incredibly important (and unpaid) job that is. Success as a mother or father is not about the $.

Long winded answer, sorry. But your question about Gates and Buffet really got me thinking.

It does not bother me that Warren Buffet and Bill Gates give to causes they care about. That is natural for humans. It bothers me that many (perhaps most) of the general public think they are better people for doing so. It is their achievements that make them great, not how they give away their wealth.

By the same token, I submit that true charity is also a self-interest. When I say true charity, I mean thoughtful action that makes the world around you better. Who doesn’t want to live in a better world?

But people also misunderstand the idea of charity. You can’t make things better by throwing money at a problem without thought, as government is wont to do. Money has no direction. It can be used to buy bread or booze or even a gun. The next time, you may not be asked for money – it may be demanded at the price of your life. This kind of thoughtless waste of resources is not charity and is in nobody’s self-interest.

Everything positive in the world can be traced back to self-interest and everything negative in the world can be traced back to someone’s callous indifference towards – or utter ignorance of – the concept of self-interest.

So, currently, I am a student of the Financial Meltdown of 2008/9. Visually, I always refer to Alan Greenspan, who is a self proclaimed devotee of Ms Rand and the principals of Objectivism in particular and of free-market capitalism in general, in order to distinguish the two separate constructs of ‘Vested Self Interest’ and ‘Personal Integrity’.

I can recall Mr. Greenspan being hauled in front of Congress and having been asked by Rep. Henry Waxman, essentially “Were you wrong?”.

You may read the dialog here: http://www.pbs.org/newshour/bb…

Or view it here: http://www.youtube.com/watch?v…

So, I ask, if there is no need for regulation and that markets would regulate themselves as Greenspan proposes, how did this collapse (I assert based on greed and perhaps unbridled self interest) happen? Is there a difference between regulation and policing? If the marketplace needed to be policed from a source other than itself, then where did the element of ‘Personal Integrity’ on a corporate scale and individual basis go?

Here we can see, that perhaps those corporate thugs and thieves were driven by excessive interest in their collective ‘self’ and not by the value of true ‘self interest’. This, perhaps needs to be culled out further and I only use this example of applied Objectivism in the Current Reality as a starting point in this conversation.

Again, I’ll let those more brilliant than I fill in the blanks…

Warren